9.1 Marketplace Research

Gong Cha @ Subang Jaya SS15

I have visited all 3 outlets of Gong Cha in Malaysia to research on Gong

Cha regarding its kiosk or outlet placement and product price. The 3 outlets

are at Subang Jaya SS15, The Gardens Mall and KLCC.

Besides, I also purchased bubble tea from its competitors to for

reviewing purpose.

9.2 Marketplace Observation

Besides observing the kiosk and outlet placement and the product price, I

also observed the market of Gong Cha in the weekend during peak and off-peak

hours. Following are the findings:

Gong

Cha

Subang

Jaya SS15

|

Gong

Cha

The

Gardens Mall

|

Gong

Cha

KLCC

|

|

Off peak hour

(3.00pm – 4.00pm)

|

26

|

42

|

37

|

Peak hour

(7.00pm – 8.00pm)

|

73

|

104

|

98

|

9.3 Online Survey

The online survey was conducted from 14th to 18th

of November 2011, with a total of 71 participants. The purpose of this survey

is to investigate on the consumer perception on bubble tea and consumer

perception towards Gong Cha.

Question 1 – What is your

gender?

Male - 56%

Female - 44%

Question 2 – What is your

age group?

12 - 16 years old - 3%

17 - 21 years old - 41%

22 - 26 years old - 49%

27 - 31 years old - 1%

32 and above - 6%

17 - 21 years old - 41%

22 - 26 years old - 49%

27 - 31 years old - 1%

32 and above - 6%

Question 3 – What is your

income?

RM1 - RM1000 - 65%

RM1001 - RM2000 - 8%

RM2001 - RM3000 - 15%

RM3000 - RM4000 - 6%

RM4001 and above - 6%

RM1001 - RM2000 - 8%

RM2001 - RM3000 - 15%

RM3000 - RM4000 - 6%

RM4001 and above - 6%

Question 4 – What is your

race?

Chinese - 79%

Malay - 9%

Indian - 6%

Others - 6%

Malay - 9%

Indian - 6%

Others - 6%

Question 5 – Have you

ever tried bubble tea?

Yes - 94%

No - 6%

No - 6%

This question investigates on how many people have tried bubble tea

before. The result shows that 94% of the responder has tried bubble tea before

and a mere 6% has not. Those who have not tried bubble tea are mostly in the

age group of 32 and above.

Question 6 – How often do

you drink bubble tea?

Daily - 1%

Several times a week - 3%

Once a week - 6%

Several times a month - 35%

Once a month - 41%

I don't like bubble tea - 14%

Several times a week - 3%

Once a week - 6%

Several times a month - 35%

Once a month - 41%

I don't like bubble tea - 14%

This question investigates on bubble tea consumption rate among the

responders. It shows that 1% of the responders consumers bubble on a daily

basis while 3% several times a week and 6% every once a week. The majority with

35% consume several times a month and 41% every once a month. There are a total

of 14% who state that they don’t like bubble tea.

Question 7– How long have

you been drinking bubble tea?

Less than a week - 8%

Less than a month - 8%

A month to 6 months - 28%

More than 6 months - 56%

This question investigates when do the responders start drinking bubble

tea. A lot of these responders which is 55% have been drinking for more than 6

months which mean even before the bubble tea trend started. The other 45% which

started to drink bubble tea for a month to 6 months, less than a month and less

than a week. This shows that the latest bubble tea craze brought back more old

bubble tea lover than attracting new customers.

Question 8– Why do you

drink bubble tea?

As a dessert - 6%

For thirst or hunger -29%

You crave it - 10%

Because it's available - 31%

Others - 24%

This question studies the reason why responders drink bubble tea. 32% of

the responders drink bubble tea because they crave for it and 30% take it as a

dessert. The other 25% stated that they drink because it is available, 11%

drink for thirst or hunger and 1% for other reasons.

Question 9– What is your

favorite brand?

Gong Cha - 25%

Chatime - 59%

Dong Cha - 8%

Ochado - 7%

Others - 1%

This question is to analysis what the favorite brand of bubble tea among

responders. As predicted, Chatime is the leading brand with most percentage

which is 49% while Gong Cha has 21%. Other brands have 17% and latest brand to

arrive in Malaysia which is Dong Cha and Ochado and 7% and 6% respectively..

Question 10– What do you

consider while purchasing a bubble tea?

Brand - 1%

Taste - 6%

Accessibility - 63%

Quality - 20%

Quantity - 68%

Price - 25%

Advertising - 85%

Others - 30%

Brand - 1%

Taste - 6%

Accessibility - 63%

Quality - 20%

Quantity - 68%

Price - 25%

Advertising - 85%

Others - 30%

This question studies what are the factors that responders consider while

purchasing bubble tea. Taste is what the responders care the most with 85%

followed by quality with 68% and price with 63%. This shows that consumers take

these 3 factors and their first priority while purchasing and doesn’t really

care about brand, accessibility, quantity and advertising that much.

Question 11– How much would you pay for a cup of bubble tea?

RM3 - RM5 - 63%

RM6 - RM8 - 28%

RM9 - RM10 - 8%

RM10 and above -1%

This question studies how much would the responders pay for a cup of

bubble tea. More than half of the responders which is 62% think RM3-RM5 is a

reasonable price while 28% would spend

RM6-RM8 and 8% would spend RM8-RM10 and 1% would spend RM10 and above. This

reflects the questions above showing cheaper bubble tea is the key of

purchasing.

Question 12– Are you

familiar with Gong Cha?

Yes - 46%

No - 54%

The question studies are the responders familiar with Gong Cha. 54% of

the responders are not familiar while 46% are familiar with Gong Cha. This shows

that Gong Cha does not have enough promotion and advertising to boost the

brand’s popularity.

Question 13– How did you

hear about it?

Newspaper, Magazine - 32%

Tv, Radio - 6%

Social network, Blog reviews and etc - 15%

Recommendation from friends & family - 47%

Others - 0%

This question analyzes how responders get to know about Gong Cha.

Recommendation from friends and families occupied 46% showing the effectiveness

of work-of-mouth while social network and blog reviews has 15%. Newspapers and

magazines have a mere 6% while TV and radio has a surprising 0%. This shows

that TV and radio wasn’t a suitable medium to promote Gong Cha. Word of mouth

and social network and blog reviews are more effective and the company doesn’t

even need to spend any money to get their product promoted so remaining good

quality beverage to impress consumers is very important. The 32% left stated

that they have not heard of Gong Cha before.

Question 14– From your

own experience, rate the quality of Gong Cha?

Excellent - 14%

Good - 38%

Average - 47%

Poor - 5%

This question is only for those who had tried Gong Cha and a chance for

them to rate the quality of Gong Cha. The majority of 34% thinks that Gong Cha

is average and 30% thinks it is good. 11% of the responders think Gong Cha is

excellent in quality while 4 % thinks it is poor. This shows that there are

still room of improvement in the quality of beverages provided b Gong Cha.

Question 15– Why would

you choose Gong Cha over its competitors?

Price - 49%

Variety - 53%

Accessibility - 33%

Lower calories - 36%

Authenticity - 16%

Sugar and ice options - 44%

Others - 7%

This question investigates why the responders would choose Gong Cha over

its competitors. Variety has the highest which is 53% followed by price with

49% and sugar and ice options with 44%. Responders care less about the

accessibility, the lower calories and authenticity of Gong Cha.

Question 16– Do you know

that Gong Cha only uses high-quality tea leaves that are brewed fresh on a daily basis?

Yes - 20%

No - 80%

This question studies whether the responders know the use of high-quality

tea leaves in Gong Cha bubble tea. 80% of the responders do not know and only

20% knows about it showing that the marketing and advertising of Gong Cha

wasn’t effective.

Question 16– Does that

makes you want to try Gong Cha?

Yes - 72%

No - 28%

This question is related to question 16 to see the willingness of

responder to try out Gong Cha after knowing that Gong Cha uses high-quality tea

leaves instead of powder. 72% of the responders show optimistic result stating

that they will give it a try while 28% still does not feel interested. The use

of high-quality tea leaves is a field that can be promoted because it really

can attract customers.

Question 18– Which part

of Gong Cha needs improvement?

Advertisement and promotion - 40%

More flavors - 11%

More strategic outlets - 31%

Packaging - 4%

Brand image - 14%

This question studies the parts of Gong Cha that wasn’t good enough and

need improvement. 39% thinks that Gong Cha need to work out their advertising

and promotion and 31% thinks Gong Cha need more strategic outlets. The brand

image, variety in flavor and packaging receive less concern from the

responders.

Question 19– Have you

heard of a news where a Taiwanese product commonly used in bubble tea drinks has been confirmed by the

Health Ministry to be contaminated with Carcinogen Diethylhexyl

Phthalate (DEHP)?

Yes - 59%

No - 41%

This question studies the awareness of responders towards the news of

bubble tea drinks been contaminated by chemical. 59% of the responders are well

aware while 41% does not know about this news.

Question 20– After

knowing the news, will you be worried while consuming bubble tea?

Yes - 76%

No - 24%

This question studies the reaction of responder after knowing the news,

will they be worried while consuming bubble tea. The majority with 76% stated

that they will be worried while 24% believes in the bubble tea outlet and says

that they are not worried.

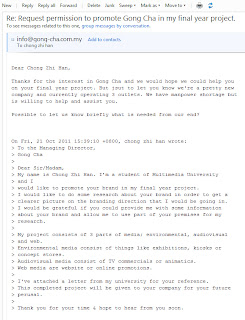

9.4 Interview

I have interviewed with the chairman of Teafe (M) Sdn Bhd, Mr. Billy Koh

via email. He was too busy to reply my email very frequently so I decided to

call the Gong Cha outlets to talk to the person in charge. The Gong Cha staffs

gave me Mr. Billy Koh’s phone number and I called him and he thinks it is

better for us to meet up. So I met him at the KLCC outlet and interviewed him

and got the information that I needed.

0 comments:

Post a Comment